Understanding the Complexity of the Margin & Collateral Processing Space, and How Transcend Can Help

- By Todd Hodgin

- Mar 4, 2024

- Blog Capital Markets CCP Margin Collateral Management Collateral Optimization Derivatives

Over the last 20 years as more markets have become eligible or mandated for clearing, efficient margin & collateral processing has become a critical business function. The most recent example includes the upcoming mandated clearing of treasuries and treasury repo instruments.

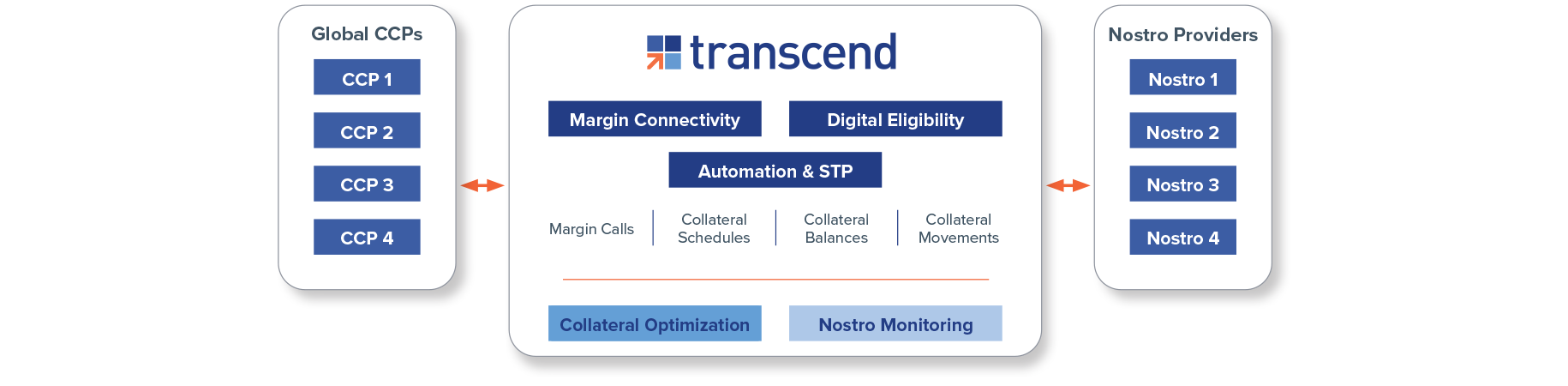

This migration to cleared markets has created a complex margin and collateral ecosystem for firms to support that can include both house and client activity, direct access to a global network of CCPs, or the use of FCMs.

To efficiently access these markets requires visibility into a variety of CCP functions. However, this is not easily accomplished. Infrastructure, integration methods, and data taxonomies differ across these venues making it difficult for firms to organize and manage their operations.

Transcend provides transparent access to this margin and collateral ecosystem through its CCP Central Solution by harmonizing:

- Collateral Eligibility Evaluation

- Margin Call Activity and excess/deficits

- Collateral Allocation

Transcend’s CCP Central solution natively integrates with its Optimization solution and Booking Service to select the best collateral to pledge to meet a margin call and automate that collateral movement — helping support critical operational processes and create a financial lift through smarter collateral decisions. Transcend’s single portal access into your CCP network creates important resiliency by directly accessing CCP margin and collateral activity alongside of the existing settlement infrastructure.