Collateral Optimization That Evolves With You

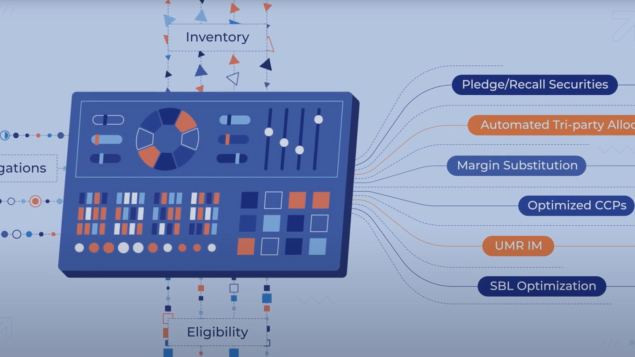

Transcend’s Optimization Engine gives its clients the power to control parameters and rules to scale with changing business priorities.

Easily configure optimization scenarios and incorporate dynamic cost parameters to achieve efficiencies that best align with your organization’s goals.

Sample Collateral Optimization Rules

- Maximize LCR

- Minimize Collateral Haircuts

- Match Asset vs Liability Tenors

- Restrict Substitutions

- Facilitate Recalls

- Net Positions Across Legal entities and Depos

- Return Excess Borrow

- Sweep to Excess to Triparty

Transcend Delivers Transformational Results By:

Identify the most efficient ways to fund your business by assigning costs, constraints, and scenarios to your inventory and identifying optimal assets to finance.

Operationalize your optimization strategy and eliminate manual processes by automating the execution of single- or multi-step collateral movements and allocations.

Implement multiple costs and constraints that align with business-policies and goals and leverage cutting-edge algorithmic processing to identify actionable recommendations for superior financial performance.

Facilitate coordinated decision making with full transparency into inventory, obligations, and eligibility schedules across business and technology siloes.

Extract Maximal Value From Your Financial Resources

Capital Markets businesses are under increasing pressure from clients, shareholders, and regulators to more effectively manage their assets, liquidity, and funding costs. Transcend’s game-changing Collateral Optimization technology has empowered its clients to save millions every year by executing the smartest collateral allocations for a single business or across the enterprise.

Run cross-product optimization to manage bi-lateral finance, triparty, and derivative margin flows from a single platform to achieve superior performance results. Transcend can seamlessly integrate with each of its client’s existing technology ecosystem for an industry-leading implementation experience.