Cash & Liquidity Management

Achieve Financial Efficiencies and Improve Risk Management

Strategically fund your business

With accurate transparency into historical, current, and projected cash balances and liquidity compositions, Transcend helps clients realize significant balance sheet improvements through smarter cash and liquidity management.

Additional Benefits

- Avoid and proactively cure cash deficits

- Prevent unnecessary draws from credit lines

- Limit the size of cash buffers in accounts

- Improve forecasting across funds / accounts

- Seamlessly comply with various liquidity guidelines, such as BCBS248

- Identify ideal funding scenarios based on business / client demands

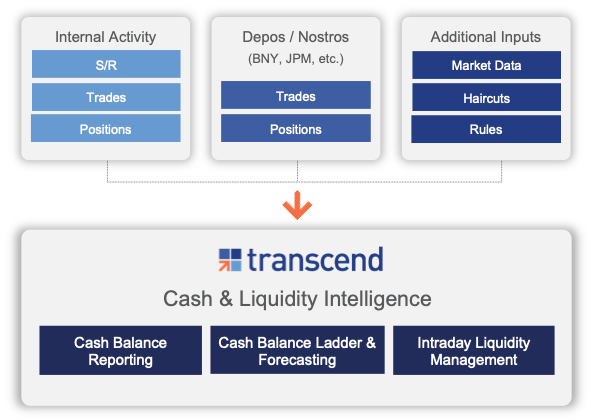

One Solution. Three Powerful Capabilities.

Transcend Cash and Liquidity Intelligence aggregates trades, positions, and cash balances across global accounts for transformational analytics and reporting.

Intraday Cash Flows & Liquidity Projections

Empower Treasury teams to improve financial performance through more efficient cash utilization and HQLA retention

With cash and securities spread across accounts with multiple custodians / paying agents, firms struggle to effectively manage liquidity and project cash balances in real-time. Without a single view of cash and securities, firms are inaccurately forecasting cash balances, inefficiently managing cash buffers, and leaving cash balances uninvested. This ultimately exposes these firms to liquidity risk while also creating a significant drag on performance.

By harmonizing cash and securities across depos, nostros, and internal accounts, Transcend empowers treasury and collateral management teams to make smarter intraday cash and liquidity decisions across the enterprise.