Bridge to the Future: The Practicality of Integrating DLT-based Securities with Legacy Collateral Infrastructure

- Bimal Kadikar

- Sep 5, 2024

- Blog Capital Markets Collateral Management Collateral Optimization DLT Inventory Management Technology

It is widely believed that crypto technology design and implementation efforts to date have laid sufficient groundwork for the broader utilization of tokenized securities in the very near future. However, it is not clear how firms will integrate this evolutionary product with their legacy infrastructure. The choice between maintaining a current technology stack and investing in new distributed ledger technology (DLT) is not mutually exclusive. Financial institutions should be preparing for a future where both traditional and DLT systems work in concert. For collateral, balance sheet, and financing transactions, the new DLT world presents distinct opportunities while “business as usual” technology and protocols will continue to serve a valuable function for many years to come.

All regulated banks, insurance companies, and asset managers operate on critical infrastructure, little of which is DLT-compatible. But trying to retrofit an older system to transact in real-time with a DLT platform may not be feasible.

As more DLT services are introduced, firms could be forced to manage two fully different sets of technology, cost structures, and data formats. While many highly efficient processes have existed for 30 or more years, there is a strategic way to integrate the stack without duplicating work efforts for current technology and again for a DLT world. This complexity should be avoided from the outset of introducing any new technology.

DLT is Ready for a Securities Ecosystem

The securities industry has seen what the crypto markets can do with DLT for trading and post-trade processing. DLT’s power of atomic, instantaneous settlement of crypto has impressed banks and investors: the operational, capital, and funding benefits are without dispute. Smart contracts and crypto exchanges operating with minimal or no oversight are used daily. Crypto markets have proven that DLT technology works and have taken multiple products, services, and even language from the securities industry to replicate their trading and post-trade environment.

As crypto has grown, DLT is gaining mindshare at major financial institutions both conceptually and for implementation. There are growing securities networks for cross-platform DLT operability. For example, HQLAX, which provides Digital Collateral Registries to digitize assets, recently announced that it had passed a milestone of €1 billion notional in outstanding agency securities lending Delivery vs Delivery (DvD) transactions. In May 2024, DTCC, Clearstream, and Euroclear published a position paper with six principles “to promote the successful adoption of tokenization and digital asset securities (excluding cryptocurrencies). It also details a comprehensive set of risk management controls to underpin the future of digital markets.” Already, the industry is talking about how hard a move to real-time T+0 settlement could be in the future without DLT.

Firms will need an operations and technology strategy that makes sense to move into production at scale. There is no expected mandate from regulators on the horizon, which means the industry must coordinate to deliver to the greatest number of participants with a vested interest in market efficiency. Market infrastructures and vendors in DLT will supply the nodes, but each bank and investment firm must be prepared to accept, use and revert back the new massive inflow of data.

How Much Value Can DLT Provide for Balance Sheets and Collateral Management?

To assess how important it may be to accommodate DLT in a current technology environment, we first ask how much DLT could impact balance sheet and collateral management. Already, trading platforms are announcing advancements, especially in providing intraday liquidity in FX swaps and repo. The promise of near instantaneous settlement for securities where payments are exchanged immediately after a trade is compelling for operational efficiency and counterparty risk, as well as significant reduction in the balance sheet for settlement exposure accounting. These are good reasons to move forward in the direction of DLT.

In the collateralized business world (repos, securities borrow/loan, cleared and uncleared derivatives), the benefits can be quite large if tokenized securities can address the major industry challenge of moving collateral across venues (triparty agents to central clearing counterparties (CCPs) to bilateral) easily, leveraging the economic benefits of assets without worrying about operational complexities. These benefits have been touted by crypto platforms but the securities industry is moving to a more practical approach of focusing on targeted problem areas – which may yield positive results in relatively shorter timeframes.

Practically Integrating DLT with Current Architecture

The DLT-based tokenized securities evolution is happening – albeit quite slowly right now. This means that firms have some time to prepare for adoption, but it is paramount to understand that this evolution will mean the current world and infrastructure will be more complex than the current state. A comprehensive platform integration strategy is a key requirement for firms working through the challenges of fusing DLT with their existing workflows. While many large firms have already embarked on the journey to develop and connect to DLT platforms, a requirement to seamlessly interface with existing platforms presents a new twist that must be considered in the speed and frequency of data movements. There is also a need to consider metadata – the data that describes the data – in these transactions to ensure that posted collateral meets eligibility requirements and is appropriate to regulatory capital thresholds. This is a complex task even before DLT.

Mandatory clearing of US Treasury repo and increasing interest in intraday repo trading present a unique dimension to industry challenges with DLT. Dealers are already trading billions in intraday repo volumes (mostly on DLT) to manage their balance sheets. For US Treasury repo, there will be activity that settles through traditional venues, outright or repo trading that may be cleared at one or more CCPs, and intraday repos trading on DLTs. Managing these settlement platforms is a daunting task for most firms; they will need capabilities that provide a holistic view across all the activities in real-time for internal purposes as well as regulatory reporting.

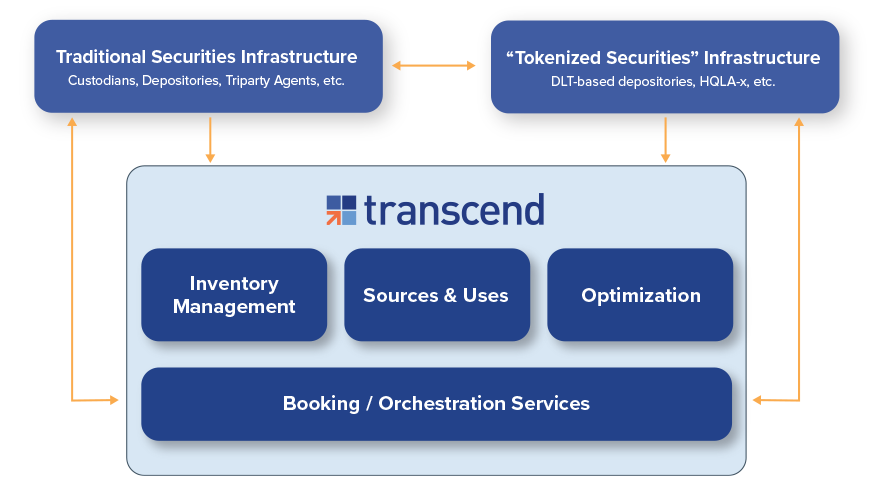

The only realistic solution is using an integration technology like Transcend that can connect with a diversity of CCPs, bilateral counterparties, triparty agents, internal technology platforms, and DLT that can effectively work across various venues and support traditional settlement methods, but can also fit with prevailing DLT platforms to support the entire ecosystem (see Exhibit 1). Standards like the Common Domain Model sound good on paper to solve these sorts of problems but the industry is not ready for that big a changeover. Proprietary and diverse data formats will be the norm for years to come.

Some critical capabilities that firms must develop are:

- A comprehensive and real-time view of assets regardless of the location or “form” (traditional or digital) in their inventory management views.

- The ability to perform all business, treasury, and operational analytics on sources and uses of collateral regardless of the location and form.

- Optimizing decision-making in such a way that the economic benefits of one asset vs. the other are evaluated along with the operational constraints of different forms of the asset. For example, an IBM or Vodafone bond at DTC or Euroclear or on a chain will have the same economic considerations but will have very different operational constraints that must be integrated into optimization decision-making.

- Tackling the additional complexity of booking automations to make sure that the overall platform is capable of moving traditional assets and digital assets in a seamless manner.

A move to DLT for the securities industry presents multiple positive opportunities. However, the reality of data integration, connecting with internal systems, and moving an organization to the speed of almost instantaneous settlement is not trivial. There is a need to build a bridge to the future to ensure that both legacy and DLT platforms and interfaces are working efficiently: this is the work ahead. While firms still have time to sort through their options, starting now to plan for the inevitability of DLT at some level in several years is a good idea for market participants at all levels.

Originally published on Finadium.com, September 5, 2024.