Global Systemically Important Bank Selects Transcend for CCP Integration

- Transcend

- Mar 6, 2025

- Blog Capital Markets CCP Margin Collateral Management Collateral Optimization Derivatives

A Global Systemically Important Financial Institution (G-SIFI) faced the formidable task of monitoring and managing margin exposures and collateral pledges across a global network of CCPs on behalf of their house and client businesses. And if this could be accomplished, how could they optimize their collateral to fuel additional savings opportunities? Transcend’s industry-leading technology enabled the integration of collateral and margin exposures across 50 CCPs, while reinforcing commitments for operational efficiencies and financial optimization.

The Challenge: Harmonizing a Global CCP Network

By utilizing both direct clearing and local brokers, the institution encountered growing operational complexity. The demand for a seamless, integrated solution to unify and optimize CCP-related activities became essential. The primary challenges included:

Complexity: Navigate CCP operational challenges as each CCP works as a silo with unique connectivity and data sharing access, requiring time and internal resources to aggregate various data flows. Moreover, this needed to be done across 50 CCPs globally.

Margin Requirements: Develop efficient tracking and management of margin calls across multiple CCPs without relying on internal resources to develop and maintain multiple integrations.

Funding Efficiency: The ability to source financial savings by optimizing collateral postings across your CCP exposures.

Liquidity Monitoring: The need to use CCP data to ensure adequate funding is consistently maintained across numerous Nostro bank accounts to satisfy calls throughout the day.

Operational and Reporting Integration: Deliver efficiencies by enhancing transparency and automation for internal teams responsible for reporting and reconciliation.

Develop Efficiencies: Centralize eligibility, positions, and margin obligation data in a centralized platform. Automate the allocation of optimal collateral postings for cleared margin requirements through powerful analytics, optimization, and STP.

The Solution: Transcend’s End-to-End CCP Integration

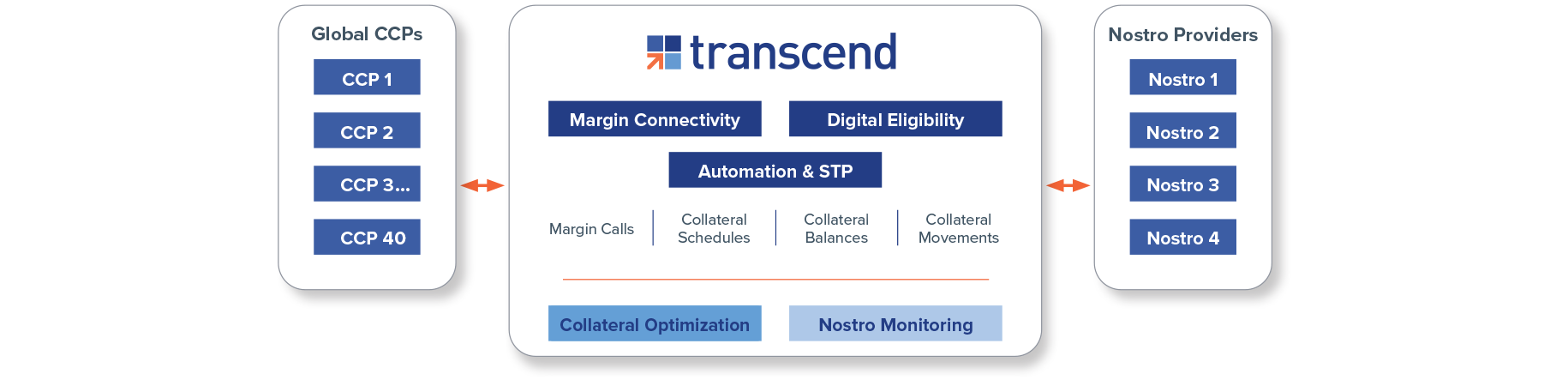

Following a comprehensive evaluation, Transcend was selected as the only end-to-end solution capable of harmonizing CCP activity while also delivering real financial results. Transcend’s platform provided a fully integrated approach by combining its CCP Central, Eligibility, Optimization, and Intraday Nostro monitoring solutions. This selection was driven by several key capabilities:

Seamless CCP Integration: Transcend’s CCP Central solution provides a unified view of margin requirements and collateral positions across 50 CCPs, ensuring a more efficient and transparent clearing process.

Collateral Optimization: The Optimization module enables real-time decision-making, ensuring that the most cost-effective collateral is posted, thereby reducing excess liquidity drain and optimizing financial resources.

Eligibility and Allocation Automation: Transcend’s Eligibility engine streamlines collateral selection and allocation, ensuring compliance with CCP requirements while maximizing efficiency.

Intraday Nostro Monitoring: By linking cash postings to nostro activity, Transcend provides real-time visibility into cash movements, enabling proactive liquidity management and reducing funding costs.

As financial institutions continue to navigate the complexities of global clearing, Transcend’s comprehensive suite of solutions positions itself as the premier choice for optimizing CCP operations. This partnership underscores the critical role of technology in driving financial efficiencies and operational resilience in an increasingly interconnected global market.

To learn more about Transcend’s CCP Central or to request a demo, click here.